Georgia Tax Breaks for Retirees

By Andrée F. Crow, CPA - 8/2017 'The Bright Side'

Most seniors are aware of the many senior discounts that various stores offer. The “Senior” status age starts at 55, 60, 62, or 65, depending on the store.

Did you know, though, that there are some significant tax breaks for senior Georgia residents?

When a Georgia resident attains 62 years of age by December 31, $35,000 of income can be exempted from Georgia income tax. This exemption can include up to $4,000 of earned income with the total earned and unearned income being capped at $35,000. This exemption does NOT include Social Security Benefits, since those benefits are already excluded from Georgia taxation, regardless of the age of the beneficiary.

When a resident becomes 65 years of age, the retirement exclusion increases to $65,000.

For the average retiree, the Georgia retirement exclusion effectively eliminates any taxable income for taxpayers 65 and older whose primary residence is in Georgia.

Several counties in the North Metro Atlanta area offer a partial property tax exemption on the taxpayer’s primary residence. Cherokee County has an exemption from school tax at age 62 on the first $377,750 of home value. Cobb County has a complete exemption from school tax at age 62. Bartow County has a school tax exemption on $40,000 of the assessed value of the home after the owner reaches age 65. All three of these counties offer additional property tax breaks based on the total household income being under certain thresholds.

The City of Kennesaw allows residents 65 and older a complete exemption from property tax on their principle residence. Kennesaw is the only city in Cobb County that has this exemption.

To receive the property tax exemptions, you must apply to the county (or city) for the exemption by April 1st of the year after you reach the qualifying age in order to receive the exemption later in the year when the property tax notices are sent out to the property owners.

While Georgia is not one the states without income tax, the tax exemptions on retirement income, Social Security benefits, and property taxes make this area of Georgia very favorable to retirees

By Andrée F. Crow, CPA - 8/2017 'The Bright Side'

Most seniors are aware of the many senior discounts that various stores offer. The “Senior” status age starts at 55, 60, 62, or 65, depending on the store.

Did you know, though, that there are some significant tax breaks for senior Georgia residents?

When a Georgia resident attains 62 years of age by December 31, $35,000 of income can be exempted from Georgia income tax. This exemption can include up to $4,000 of earned income with the total earned and unearned income being capped at $35,000. This exemption does NOT include Social Security Benefits, since those benefits are already excluded from Georgia taxation, regardless of the age of the beneficiary.

When a resident becomes 65 years of age, the retirement exclusion increases to $65,000.

For the average retiree, the Georgia retirement exclusion effectively eliminates any taxable income for taxpayers 65 and older whose primary residence is in Georgia.

Several counties in the North Metro Atlanta area offer a partial property tax exemption on the taxpayer’s primary residence. Cherokee County has an exemption from school tax at age 62 on the first $377,750 of home value. Cobb County has a complete exemption from school tax at age 62. Bartow County has a school tax exemption on $40,000 of the assessed value of the home after the owner reaches age 65. All three of these counties offer additional property tax breaks based on the total household income being under certain thresholds.

The City of Kennesaw allows residents 65 and older a complete exemption from property tax on their principle residence. Kennesaw is the only city in Cobb County that has this exemption.

To receive the property tax exemptions, you must apply to the county (or city) for the exemption by April 1st of the year after you reach the qualifying age in order to receive the exemption later in the year when the property tax notices are sent out to the property owners.

While Georgia is not one the states without income tax, the tax exemptions on retirement income, Social Security benefits, and property taxes make this area of Georgia very favorable to retirees

-------------------------------------------------

8/12/17

AVOID HOLLY STREET If you are going towards Holly Springs avoid Holly Street if possible. There is a considerable amount of resurfacing being done from Keeter Rd to near the 575 Overpass. Watch for single lane traffic with flagmen and backed up traffic. Probably several more days of this to come.

8/4/17

USPS Holly Springs to relocate:

Around the first of the year the Holly Springs branch post office will be closing and re-opening about 1/4 mile away in the strip mall just across the parking lot from the Wal Mart store. The new location should take up 2 units of the strip mall "in the center" as one of the clerks told me. No firm dates are available, don't know which of the current tenants will be leaving.

VOLCANO HOUSE

I commented on the restaurant July 31st and was back there today for a second lunch. The first visit I gave it a B- today it gets an A for the General Tao chicken lunch. This restaurant went through a change of ownership, the original owners, then a second one and now back to the first owner who has several other similar restaurants. It makes a change from Viva Mexico, Zaxby's and Wendy's. You might give it a try.

8/3/17

3 WAY STOP NOW AT 575 KEETER ROAD

This is at Prominence Way, the entrance road to the new Parc subdivision. It went up today, Thurs, Aug 3rd and it is permanent T-Junction 3 way stop, it is not a temporary signage just for the building of the development.

-------------------------------------------------------------------------

8/2/17

DOUGLAS PROPERTY MANAGEMENT - 1.9 out of 5 Stars

On https://reviews.birdeye.com/douglas-property-management-148…

Douglas, aka DPM, is and has been since the establishment of Holly Mill, the property management firm for the HOA.

Douglas, aka DPM, is and has been since the establishment of Holly Mill, the property management firm for the HOA.

If you take a look at the reviews you will see some with a 5 star rating, you might recognize some of the first name and last initials of posters as they are the HOA officers and they pitch in to try to get the star ratings for DPM past the 1 star level.

Neither Douglas nor the HOA officers are at all interested in providing information to the 663 owners in the 4 phase development.

Take for instance my inquiries of 10 weeks ago about how much the redo of the tennis courts was costing, how many firms bid on the project and if any of the people associated with the firm that got the bid were in any way connected to Douglas Property Management.

None of this was ever answered.

What was done was to disable (ie: ban) my use of the HM internet site http://www.holly-mill.com/. My lawyers inquiries to their lawyer got the reply that I was banned because I was to negative and my access would only be restored if I promised not to continue to be critical of the HOA.

Obviously I could sue, but it would cost several thousands of dollars and if you are up on the site you already know it isn't very good and is almost never updated, so an expenditure of thousands is not worth the effort.

I have 3 blogs dealing with Holly Mill and one Facebook page and you are invited to take a look at all of them.

Here are the direct links and I can be reached at hollymill30114@aol.com

Corner Of Ilex Dr At Promince Point Parkway Canton, Georgia

Davey (Registered User)

Original Poster might consider trying to involve the Holly Mill BOD and/or the property management firm Douglas Property Management. Neither is much good, but as the saying goes: "Even a blind squirrel can now and then find an acorn." Give them your suggestion, 'maybe' they will look into it. Also take a look at: http://hollymill30114.blogspot.com/ for more info.Yes, cars come around this semi-blind curve at 40 mph and you have to edge out to get a better view, but it has been that way for over a decade, so probably there won't be any 4 way stop unless there is a fatal accident.

_________________

VOLCANO HOUSE, THE PUBLIX CENTER -

a new Chinese and Thai restaurant at 130 Prominence Point Parkway.

Just a few doors from Publix and the Mexican restaurant 'Viva Mexico'. In addition to eating in they do both take out and delivery.

Below: 50% of their menu FYI -

Haven't eaten there yet but might drop in this week.

Aug 1 (Tues) Update: Had lunch there today, the Massaman Curry at $8.95, from the Lunch Special (Thai) section of the menu (less 20% per the coupon). This restaurant has been there for some years, I recall eating there about 18 months ago, just new owners now. I would rate the meal as a B- and will go again for something else.

Aug 1 (Tues) Update: Had lunch there today, the Massaman Curry at $8.95, from the Lunch Special (Thai) section of the menu (less 20% per the coupon). This restaurant has been there for some years, I recall eating there about 18 months ago, just new owners now. I would rate the meal as a B- and will go again for something else.---------------------------

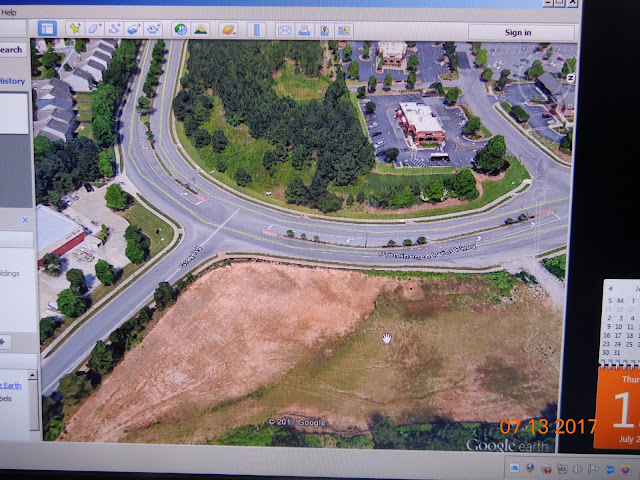

NEW STOP SIGN AT 575 KEETER ROAD and PROMINENCE WAY:

Initially the entrance to the new 13 acre townhome development, Parc on Prominence, had decelleration/acceleration lanes for entering and leaving the subdivision.

Seems that after their install and putting down sod and landscaping (10 days ago) someone decided that this was going to make for a dangerous intersection. Better to spend 25K now and change it to a 3 way stop T-intersection than be in litigation for years over accidents or deaths due to poor street design.

The new Stop signs will be up 8/3/17 and it may be annoying to have to stop, but keep in mind that those going from The View towards Holly Street have an uphill right hand curve which gives you only about 125 feet of warning that there is an intersection ahead.

So a 3 way stop without any turn bays seems to be the correct call on this traffic issue.

(parc@smithdouglas.com)

The dirt below is where the dedicated right turn lane was before they removed it in favor of the 3 way Stop at a simple T-intersection.

You can see that there is a very limited sight line for those who would be exiting the subdivision, so a Stop sign really is necessary for safety.

See also: https://seeclickfix.com/issues/3597051

7/29/17

HOLLY MILL POST OFFICE TO RELOCATE

In a July 6th letter to the Holly Mill City Manager Robert Logan, the USPS notified him that the small and cramped post office at 3235 Holly Mill Parkway, (1/2 mile from Walmart) would be relocated to a site nearby, but not yet identified.

The same services as at the existing site will be available at the new location.

The current site is the closest USPS facility to the various Holly Mill subdivisions (1.5 miles from The View) and parking has always been a problem for patrons.

---------------------------

From: Deborah Seale Mathews to HOLLY MILL Residents

1 hr ·

I was driving up Keeter Rd from Holly St. earlier today and noticed a sign that says they are putting up a stop sign on 8/3 at the new subdivision being built. Don't know if it's temp during the construction or will be permanent.

===================================

Reply -

I saw that notice a couple of days ago. I can see it as needed for all the construction vehicles coming and going over the next year.

Going from The View towards Holly St there is a bend to the right just as you are approaching the entrance to The Parc at Prominence development, at 575 Keeter Rd, which may make it prudent to have a stop sign there. Coming from the View you don't get a lot of notice that there is a major townhome development just around that bend.

From Holly Street you get a good look before the junction.

I guess we will get use to it after a bit.

I guess we will get use to it after a bit.

-------------------------------

7/21/17

From: billy.peppers@cantonga.gov

To: HollyMill30114@aol.com

CC: gene.hobgood@cantonga.gov, farris.yawn@cantonga.gov, bill.grant@canton-georgia.com, mhogan@cherokeetribune.com

Sent: 7/21/2017 10:05:01 A.M. Eastern Daylight Time

Subj: Re: Follow Up: View of approaching traffic blocked by trees

To: HollyMill30114@aol.com

CC: gene.hobgood@cantonga.gov, farris.yawn@cantonga.gov, bill.grant@canton-georgia.com, mhogan@cherokeetribune.com

Sent: 7/21/2017 10:05:01 A.M. Eastern Daylight Time

Subj: Re: Follow Up: View of approaching traffic blocked by trees

The City did not "tweek" the issue. Someone unauthorized removed

the tree. Public Works will be replacing the crepe myrtle. Thank you for

bringing this to our attention.

7/20/17

RE: Traffic Issue:

I see that the City has tweeked the issue and removed 1 of the 3 trees that block the view at Gray Rd and Prominence Point Parkway. So there is a bit better view of oncoming traffic, but they really need to go back and at the very least remove the second (middle) tree also.

These trees are not going to get any smaller and all 3 of them should be removed, not just one of them.

Commissioners voted June 6 to advertise a millage rate of 5.528, down from 5.680 last year, with the use of $500,000 in reserves to support its general fund for the upcoming year.

But Cooper said at Tuesday’s final public hearing that they were able to achieve a rate below the full rollback and the rate of 5.483 was unanimously approved by commissioners.

“About a month ago, before we were able to complete our review of revenue and based on the information the tax assessor’s office provided us as well as expenditures as we were finalizing our negotiations in the budget, we asked you at that time that we did not propose a full rollback of the general Maintenance and Operations millage rate,” he said. “We then must advertise the three public hearings and post a notice of property tax increase. The first public hearing that was presented to you that we would be recommending a full rollback of the millage rate.”

Cooper said the millage rate that was approved by commissioners is a .04 percent decrease to the full rollback millage. The millage adopted by commissioners would include 5.483 mills for the general fund, 3.298 mills for the fire fund and 0.581 mills for the parks bond, which means a total rate of 9.362 mills.

Commissioners also approved the Cherokee County School Board M&O and Bond of 19.45 mills for a total of 28.812 mills county-wide. The plan adopted includes a 3 percent cost of living raise for county employees.

Cooper said the proposed 2018 zero-based budget is about $85 million and the major change is that the county will be using $4 million in reserves to pay down the principal balance of the Resource Recovery Development Authority bonds for the Ball Ground Recycling project, reducing the bond debt to $9.2 million.

He said according to the latest tax digest, home values in the county increased by 8.58 percent before appeals. “Although we’ve been blessed to have an increase in the digest due to growth, we also had increase to current properties based on the assessments,” Cooper said. “Our goal is to at least rollback the millage rate to offset the average increase in the assessments based on what the tax assessor’s office provides us.”

Major changes to the general fund, Cooper said, include 15 new full-time positions with public safety, a new maintenance position, vehicle and custodial services with facilities management, and salary increases and new equipment for the public works department.

The county manager said changes to the fire fund included the addition of the Canton Fire Department through the consolidation that occurred last year and the hire of 16 new fire department and EMS positions.

Cooper said of the $526.05, which is what the average homeowner would pay in taxes for the 2018 fiscal year with the proposed budget and 3 percent COLA, more than half of property taxes from residents would go toward law enforcement and judicial services.

Former Cherokee County Republican Party Chairman Rick Davies thanked commissioners and staff for reducing the general M&O millage rate.

“I think that is great news,” he said. “Especially since it is going below the rollback rate. We greatly appreciate that, or at least I do.” Davies said he was prepared to discuss what was originally advertised by the county of a tax increase.

“And hearing this tonight I am pleased to see that we are rolling back, but I would like to see us roll back to revenue neutral or below revenue neutral across the board,” he said. “But this is a great beginning. My other concern is with assessments going up; we’ve got several older folks in the county that share the concern that because of this increase in assessment values they will end up paying more in taxes.”

Davies told commissioners and staff to take consideration in the future of home assessment values that have increase anywhere from “7 percent to over 20 percent.”

“I do understand that you do not set those values but we do need to take that into account,” he said. “I would really like for us to adhere to those Republican values and whenever and wherever possible attempt to reduce the tax burden on citizens in the county.”

Other jurisdictions in Metro Atlanta are considering an increase not only in their rollback millage rates but in their current rates, Cooper said. Gwinnett County’s rollback rate for their millage would be 6.608 and they are considering a rate of 7.400. Cobb County’s rollback rate is 6.252 and they are considering a rate of 6.89. Henry County’s current rate is 12.733 and they are considering a 13.733 with a rollback rate of 12.098, he said.

--------------------------------------------

7/13/17

SEE CLICK FIX - Internet Site

The City of Canton uses this site to encourage residents to report concerns that need the attention of the City of Canton: https://seeclickfix.com/canton_3 (The issue is now posted there and available for comments)

Go take a look and if you have an issue you can post or if you agree or disagree with another poster you can put in your opinion.hur issue is being held for moderator approval. Once approved, you may receive an email.our issue is being held for moderator approval. Once approved, you may receive an email.

TRAFFIC ISSUE NEEDS ATTENTION:

July 13, 2017

Dear Sirs:

There is a site for reporting issues https://seeclickfix.com/canton_3 and I did some month's ago, notice that this traffic issue was brought up. The reply to the person was pretty much a fob off which I am sure was not appreciated by the citizen.

I then have since gone back to the site to try to find the complaint, no luck, maybe it was further back than I looked or maybe it was removed.

Prominence Point Parkway, from the Publix shopping center, is a downhill road going into a sharp curve.

Intersecting the Parkway is what was once called 'Grey St', now flagged as the 'Ash St Connector', it runs from Ash Street to the Parkway, about one city block long and it is on the East side of the Dollar Store.

Many folks use this cut through when they see that there is a line in the turning lane at the Parkway and Marietta St, it saves a bit of time waiting in line for the turn arrow.

As earlier referenced, the initial citizen complaint was that the 3 small bushy trees limited the view of traffic coming downhill from the Publix area, making it unnecessarily dangerous to turn left onto the Parkway.

Several months have passed, the trees have grown a bit and the situation remains a problem that needs to be corrected. I have appended some photos, 2 of mine taken today and some from Google Earth.

My suggestion is that the 3 trees simply be dug up and moved to another location and low growing shrubs replace them. Do this all at one time and you can simply drop the new plants into the already dug holes.

Having worked as an investigator for a law firm I would suggest that if there is a serious accident or death at that intersection, due to limited visibility of drivers, then the defendant with the deepest pockets will be the City of Canton and their insurance company.

Any discovery by the Plaintiffs lawyers should reveal that this issue has been raised before by concerned citizens asking for it to be changed.

Will the City now please get these 3 trees removed/relocated.

Bill Harris

Citizen Journalist

This issue is at: https://seeclickfix.com/issues/3597051

See photo attachments-

The 3 Trees that need to be relocated or just removed.

Here is the reply:

From: billy.peppers@cantonga.gov

To: gene.hobgood@cantonga.gov

CC: HollyMill30114@aol.com, farris.yawn@cantonga.gov, bill.grant@canton-georgia.com

Sent: 7/13/2017 5:42:35 P.M. Eastern Daylight Time

To: gene.hobgood@cantonga.gov

CC: HollyMill30114@aol.com, farris.yawn@cantonga.gov, bill.grant@canton-georgia.com

Sent: 7/13/2017 5:42:35 P.M. Eastern Daylight Time

Subj: Re: 5 pictures for you

Mr. Harris,

In reviewing your pictures, I'm happy to look into the situation. It appears to me that the use of Ash Street Connector to turn left onto Prominence Parkway would simply be to avoid the signalized intersection at Prominence Parkway and Marietta Highway. I believe that even if the crepe myrtles were removed, this would remain a dangerous intersection for left turns from Ash Street Connector to Prominence Parkway. The best way to provide for public safety would likely be to post a sign on Ash Street Connector to remove the ability to make left turns onto Prominence Parkway so that traffic is diverted through the safer intersection at Prominence and Marietta Hwy.

We will look into this possible solution.

------------------- MORE ------------------------------

On Jul 13, 2017, at 6:11 PM, HollyMill30114@aol.com wrote:

------------------- MORE ------------------------------

From: billy.peppers@cantonga.gov

To: HollyMill30114@aol.com

CC: gene.hobgood@cantonga.gov, bill.grant@cantonga.gov, farris.yawn@cantonga.gov

Sent: 7/13/2017 6:35:07 P.M. Eastern Daylight Time

Subj: Re: 5 pictures for you

To: HollyMill30114@aol.com

CC: gene.hobgood@cantonga.gov, bill.grant@cantonga.gov, farris.yawn@cantonga.gov

Sent: 7/13/2017 6:35:07 P.M. Eastern Daylight Time

Subj: Re: 5 pictures for you

We will sit down and look at options to best meet the needs of traffic

safety.

Billy Peppers,

Billy Peppers,

City Manager

On Jul 13, 2017, at 6:11 PM, HollyMill30114@aol.com wrote:

In a message dated 7/13/2017 5:42:35 P.M. Eastern Daylight Time, billy.peppers@cantonga.gov writes:

"The best way to provide for public safety would likely be to post a sign on Ash Street Connector to remove the ability to make left turns onto Prominence Parkway so that traffic is diverted through the safer. . . "

WOW, didn't expect that reply.

You seriously need to get some local input on that out of left field idea.

I can think of 3 issues in the 10 seconds since I read that. I would be happy to go into details but hope it would not be necessary.

Just get those trees moved and the problem is solved.

Above: As posted on: https://seeclickfix.com/issues/3597051 and https://seeclickfix.com/canton_3

---------------------------------------------------

County set to adopt rollback millage, SPLOST projects head back to commissioners

The county will hold a special called meeting at 11 a.m. for the second public hearing for the full rollback rate of 5.483, and will hold the third public hearing at their regularly scheduled meeting Tuesday night.

Commissioners plan to vote on the tax rate at 6 p.m. at the Cherokee County Administration Building, 1130 Bluffs Parkway in Canton, for the county millage rate as well as the millage rates approved by the Cherokee County Board of Education.

Commissioners voted June 6 to advertise a millage rate of 5.528, down from 5.680 last year, with the use of $500,000 in reserves to support its general fund for the upcoming year.

However, Cooper told commissioners at their June 19 meeting he met with the county finance team and they were able to present a full rollback.

“I want to thank the chairman and commissioners for their leadership and guidance throughout the process, as well as all agencies and departments who worked closely with me during budget negotiations,” Cooper said last month. “In addition, I want to thank Stacey Williams, as well as Jimmy Marquis, finance director, and members of the finance team including Delaine Cagle, Ariana Freimuth and many others for their exceptional budgetary and analytical skills. It was indeed a ‘team effort.’”

The plan adopted includes a 3 percent cost of living raise for county employees.

Cooper said the proposed 2018 zero-based budget is about $85 million and the major change is that the county will be using $4 million in reserves to pay down the principal balance of the Resource Recovery Development Authority bonds for the Ball Ground Recycling project, reducing the bond debt to $9.2 million.

Cooper said according to the latest tax digest, home values in the county increased by 8.58 percent before appeals.

Major changes to the general fund, Cooper said, include 15 new full-time positions with public safety, a new maintenance position, vehicle and custodial services with facilities management, and salary increases and new equipment for the public works department.

The county manager said changes to the fire fund included the addition of the Canton Fire Department through the consolidation that occurred last year and the hire of 16 new fire department and EMS positions.

Cooper said of the $526.05, which is what the average homeowner would pay in taxes for the 2018 fiscal year with the proposed budget and 3 percent COLA, more than half of property taxes from residents would go toward law enforcement and judicial services.

The proposed millage rate to be advertised would include 5.483 mills for the general fund. Additionally, they are expected to set rates of 3.298 mills for the fire fund and 0.581 mills for the parks bond, which means a total rate of 9.362 mills.

Also on Tuesday’s agenda is an Intergovernmental Agreement between all municipalities in the county for the Special Purpose Local Option Sales Tax projects that will head to voters Nov. 7.

The county and cities of Cherokee have identified their major improvement projects for the upcoming penny sales tax and if approved by voters, the proposed six-year extension would begin in August 2018 and is expected to bring in about $253 million to county coffers.

The SPLOST approved by voters in 2010 will expire next year.

Unincorporated Cherokee County has about 71 percent of the county’s population. Cities would also be included in the funding mechanism and receive 29 percent to split among the county’s five municipalities.

The plan for the funds earmarks $23 million to fund an addition to the county’s jail, as well as about $18 million for an expansion of the county’s judicial facilities.

-----------------------------------------

For my 71st birthday I got a new shirt and a new haircut.

NOTE: This blog continues

click on the 'Older Posts' link

below to see many more posts.

No comments:

Post a Comment

Note: Only a member of this blog may post a comment.